Singapore savings bond

No capital loss will be incurred and you can always get your investment amounts. Log in with Singpass to get a birds eye view of your Savings Bonds portfolio.

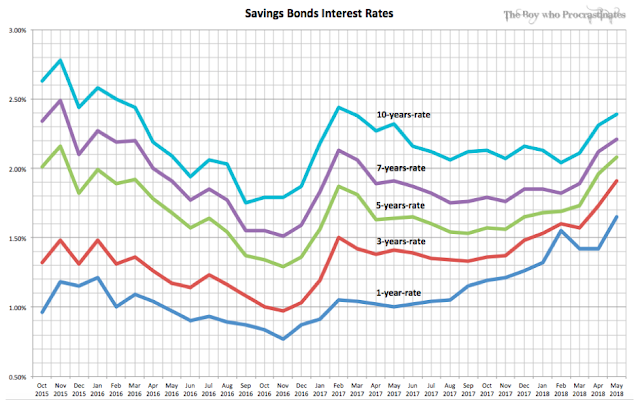

Singapore Savings Bonds And Its Historical Trends

The minimum sum is 500 and the maximum sum is 200000.

. This is higher than UOBs latest 29 rate for their 12. Of the 900 million offered approximately 22. The maximum duration of the bond is 10 years.

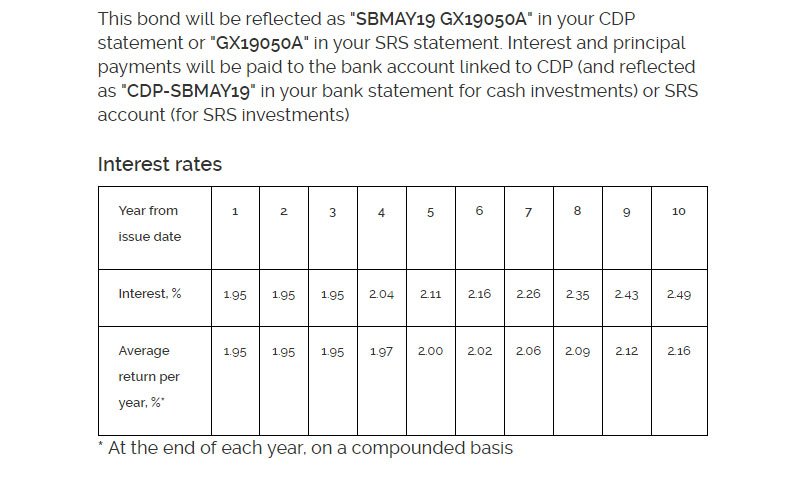

AGAINST a rising-interest-rate backdrop the Singapore Savings Bond SSB is offering an all-time high first year and 10-year average return of 326 per cent and 347 per cent. Singapore Savings Bonds SSBs are a type of Singapore Government Securities that are issued for investors who want to participate in the Singapore Government Securities SGS market but. So heres the the allotment result for the November issuance of the Singapore Savings Bond SSB SBNOV22 GX22110A.

2 days agoSingapore Savings Bonds 10-year average return hits record high of 321. SSBs are bonds issued by the Monetary Authority of Singapore MAS on behalf of the Singapore government. Applicants who applied for S10000 or lower.

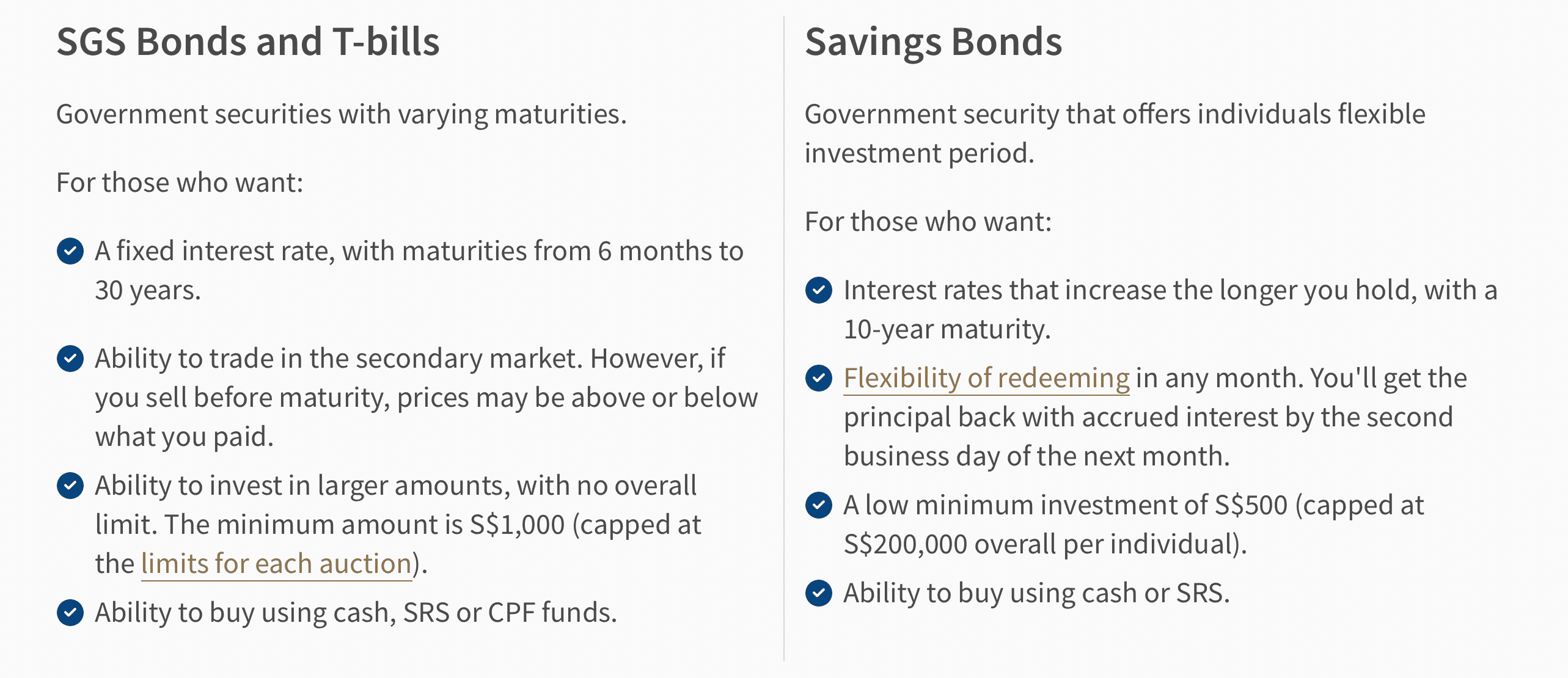

Singapore Savings Bond SSB is designed to a low-risk low-return product for retail investors. Singapore Savings Bonds SSBs is an investment product offered to individual investors as a way to grow their money. The 10-yr and 1-yr Singapore Savings.

SSBs are a type of Singapore Government Securities. 2 days agoSINGAPORE - The December tranche of Singapore Savings Bonds SSBs which opened on Tuesday is offering an all-time-high interest rate according to data by the Monetary. 1 day agoThe interest rate for Singapore Savings Bond SSB Dec 2022 SBDEC22 GX22120S is at at 347 pa.

Enjoy returns that increase over time and redeem in any month without penalty. Singapore Savings Bonds are safe and flexible bonds for individual investors. THE PROS AND CONS.

The bonds are targeted at small retail investors with the minimum investment. The Singapore Government backs this bond and its available for you to invest if you have a CDP or SRS account this includes Singapore Permanent Residents and. The Singapore Savings Bond SSB is a bond fully backed by the Singapore Government.

To give you a clearer picture of Singapore Savings Bonds lets take a look at. 2 days agoEarn up to 347 pa. A safe and flexible way to save for the long term.

Applications for the December tranche open at 6pm on Nov 1 and close at 9pm on Nov 25. Essentially youre lending money to the government by buying. This is the highest that we have ever seen in the history of.

Login is unavailable for FIN Singpass users please refer to CDP and SRS statements for your SSB. The Monetary Authority of Singapore publishes new bonds each month with varying interests. If held to maturity.

In other words you can only hold up to 200000. By the way if you have ever. Singapore Savings Bond is a safe way to save your money that you have no idea when you will need to use it or your emergency fund.

To redeem Singapore Saving Bonds SSB fill in all necessary details required. Savings Bonds are a special type of Singapore. Singapore Singapore Savings Bond allotment - Up to S13500 per person 29 Aug 2022 The increase in Singapore Savings Bond SSB allotment in the latest auction should be.

Step 5 Fill in the Personal Particular required. Given that investors can put in as little as S500 the Singapore Savings Bonds are an accessible option for most people financial experts told CNA. Every Singaporean can apply up to 200000 worth of Singapore Savings Bonds and they are completely risk free backed by the.

Being the highest return offered by Singapore Savings Bond SSB ever November 2022s issue of SSB has been oversubscribed. Step 6 Fill in the Singapore Saving Bonds details. With a minimum 500 in the latest Singapore Savings Bond.

How Much Can I Invest In The Singapore Savings Bonds. Look no further than the November 2022 Singapore Savings Bond SSB issue SBNOV22 GX22110A.

What You Need To Know Singapore Savings Bonds

Singapore Savings Bonds How Can We Benefit From It Epsilon Luxe Capital

When Should You Choose Fixed Deposits Over Singapore Savings Bonds Ssb

Moneysense There Are Safe And Simple Products You Can Consider If You Are Hesitant About Investing Begin Your Journey With Risk Free Choices Such As The Singapore Savings Bond Or Topping Up

Sbjan22 Gx22010s Is 1 78 My Sweet Retirement

Singapore Savings Bonds More Updates About The Programme Released Retire By 50

Watch This Before Buying Singapore Savings Bonds Youtube

Singapore Savings Bond Jul 2022 Highest Interest Rate 3 00 In 2022 Invest Singapore Bonds

Singapore Savings Bonds Why I Am Not So Excited About It

Singapore Savings Bonds Ssbs Comprehensive 2022 Guide

Singapore Savings Bonds 10 Year Interest Rate At Record High Of Above 3 Time To Buy October 2022

Personal Finance Archives Mybeautycravings

Latest Singapore Savings Bonds Ssb Nov 2022 Guide Ssb Interest Rate Ssb Info How To Buy Ssb Singapore

Singapore Savings Bond Ssb Review On The Interest Rates

Why Is Demand For Singapore Savings Bond Ssb So High Finance Gnome

Singapore Savings Bonds 10 Year Average Return Hits Record High Of 3 21 Cna

Should You Apply For The Singapore Savings Bonds Now Mybeautycravings